Home » Knowledge Center » User Guide » Bills

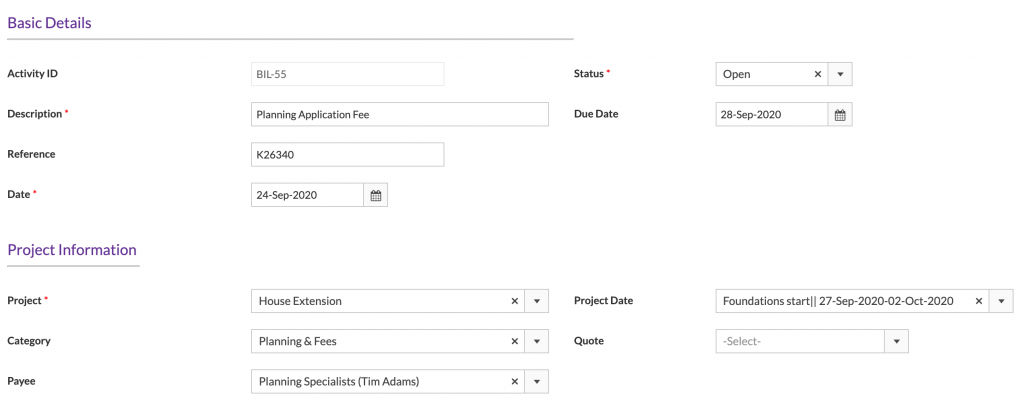

Bills.

The Bills feature is used to capture bills that need to be paid primarily for services. Examples include:

- Legal Bills

- Service Charges

- Utility Bills

- Finance Payments – mortgage/loan/credit cards

- Interest payments

- Fines

Where a product has been purchased but payment and receipt of the goods occurs at different times, an Order would be raised. Where goods are collected and paid for at the same time of purchase an Expense would be raised.

Status

Open – is currently active and will appear in the ‘Open’ reports and financial information will appear in all dashboards and finance reports.

Closed – is completed and will appear in the ‘History’ reports. Financials will be included in Finance dashboards and reports

Cancelled – is no longer required and will appear in the ‘History’ report but will not be included in any dashboard or financial report

Due Date

Due Date is used to track the bill. The app will automatically flag the bill if the Due Date has passed and the bill status is not closed or cancelled. This will also appear on dashboards. If a due date is not set it will always be flagged as ‘Not Overdue’.

Cost Breakdown

- Automatically based on Line Items

- Manually (default)

Automatically based on Line Items