Home » Knowledge Center » User Guide » Budget Analysis

Budget Analysis.

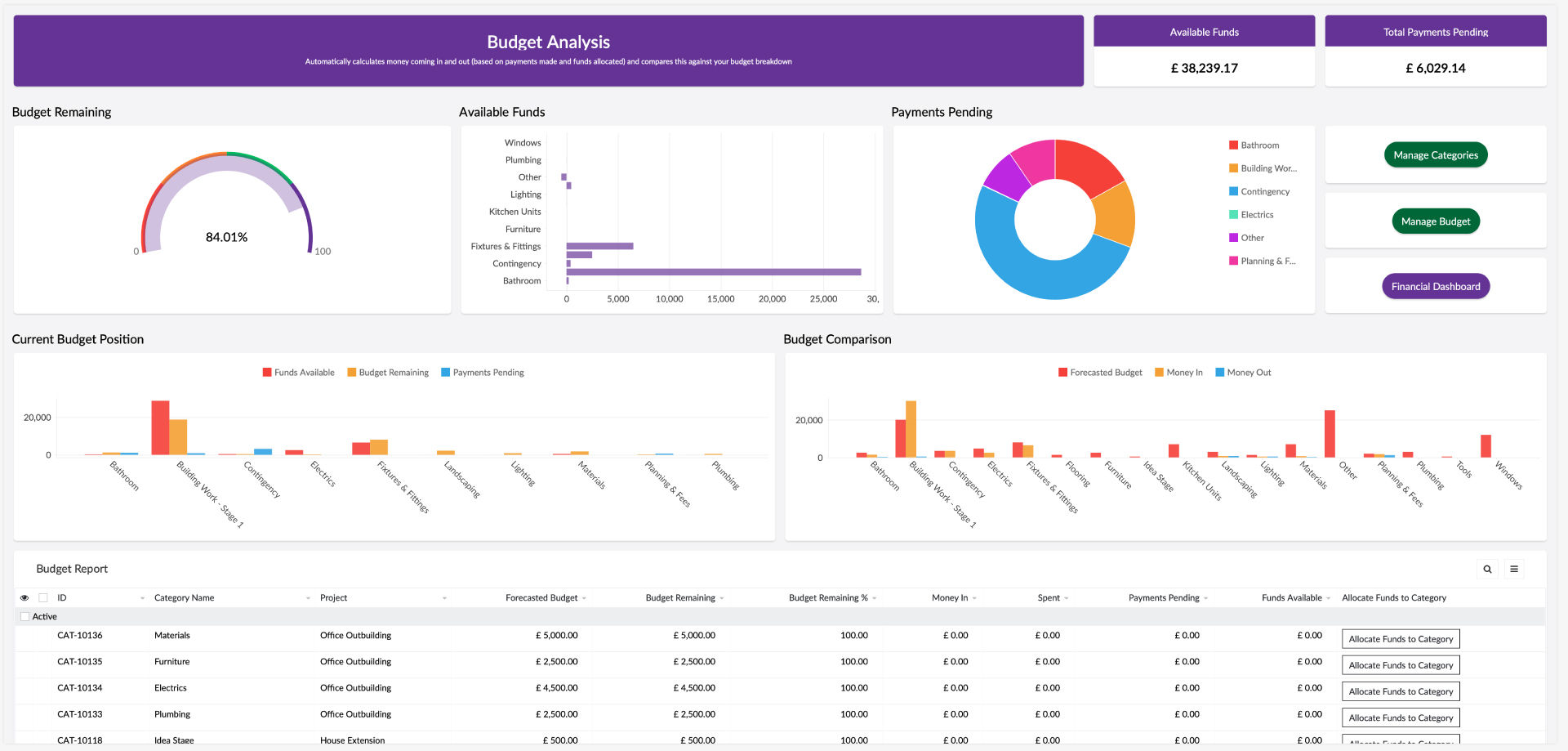

Budget Analysis calculates your financial position so you don’t have to. The dashboard provides analysis across a number of areas:

- Budget Remaining

- Available Funds by Budget Category

- Payments Pending

- Budget Position

- Budget Category Comparison

Budgets Explained

There are a few figures to understand to get the most of what the analysis has to offer.

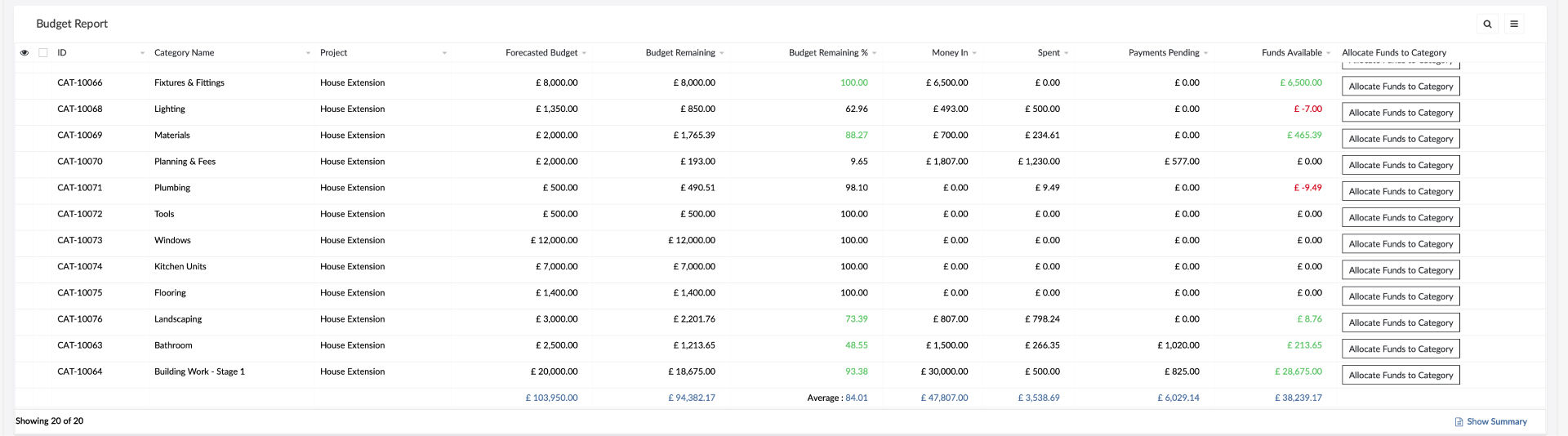

- Forecasted Budget – amount you expect to budget for each category

- Budget Remaining – budget remaining after Spent and Payments Pending have been deducted

- Money In – this is the amount of money that has been received (refunds are not included, but are applied to Spent)

- Spent – total amount actually paid for activities (bills, expenses, orders etc.)

- Payments Pending – total amount still left to pay for open activities (e.g. final balance to pay after a deposit has only been paid)

- Funds Available – total amount of money you have actually allocated to the budget category. You may have forecasted a budget of £5,000 for a category but you might only have £2,500 for this month. So you would allocate the £2,500 and then allocate more funds when you have it. The dashboard will tell you if you will spend more than you have funded helping you to manage your funds and move money around. Remember there is a difference between forecasting a budget and actually having the funds available to spend.

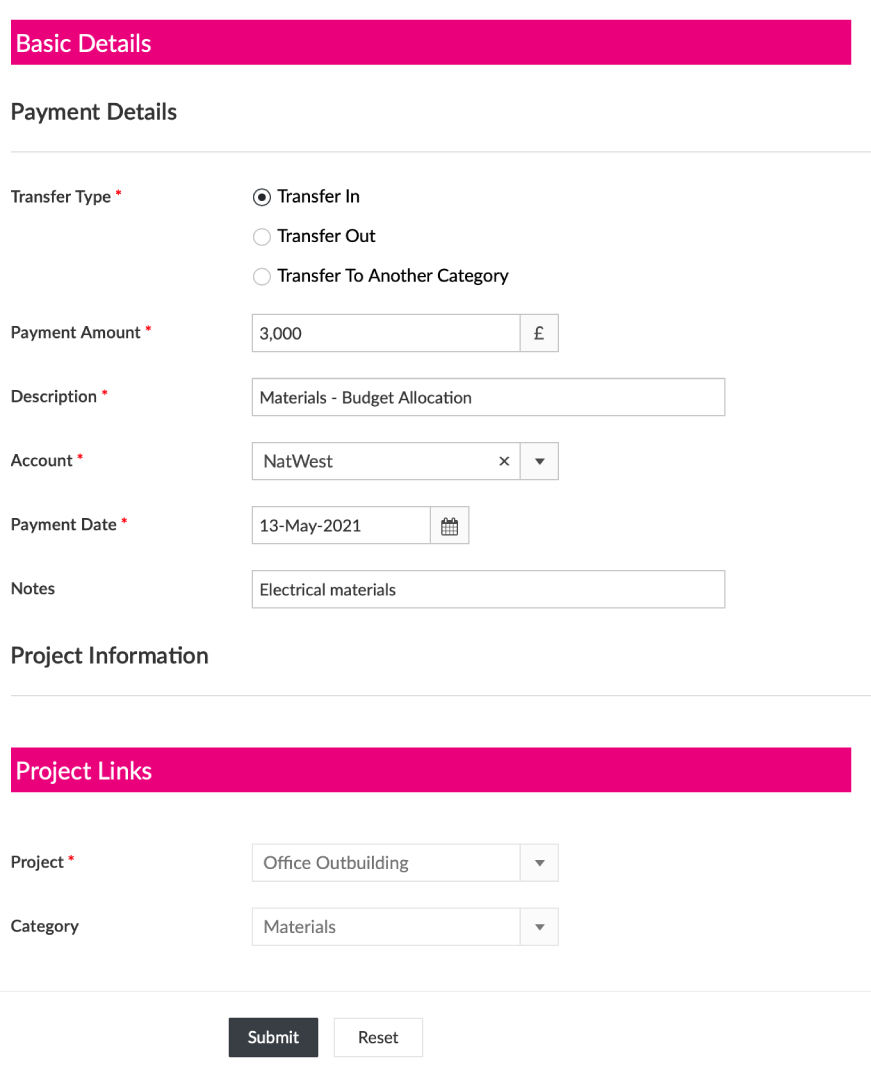

Allocate Funds to a Budget Category

Now that you have identified how you intend to spend your money across the categories, you need to determine what funds you have available for your categories. Not everyone has all their funds in place at the start of the project.

1. Transfer In – transfer funds into a category (credit)

Example: You have budgeted £5,000 for Electrics but only have £3,000 in the bank. The remaining £2,000 will come from a bank loan in 2 months. You can fund your budget with £3,000 and your spending will automatically reflect against it. If you have spent less than £3,000 then great you still have funds remaining. When you receive the loan you can top up your funds for that category.

2. Transfer Out – transfer funds out of a category (debit)

Example: You have budgeted £5,000 and transferred in £5,000. You then realise you only need £4,000 in funds. You can transfer out the £1,000.

3. Transfer To Another Category – deduct funds from Category A and credit funds in Category B

Example: You have budgeted £5,000 for Electrics and transferred in £5,000. You then realise you need £1,000 for Plumbing. You can transfer £1,000 from Electrics (debit) to Plumbing (credit).